https://sa.www4.irs.gov/modiein/individual/index.jsp

If eligible to file. Get Your Tax Record.

You can request an Account Transcript by mail.

. In addition to standard Website accessibility features we implemented. You will be walked through the application and receive your number immediately. In order to obtain an EIN from the IRS you must know what type of structure or organization you are setting up.

Page 5 of 7 The name should be. Sheridan High School Class of _____ Do not use the name of a person. If Form 1023-EZ appears compressed on Paygov when using Internet.

Im trying to get a end-of-the-year EIN for a savings plan. What to do if you havent filed your tax return. You did not move to a new page within 15 minutes so your session expired.

Youve successfully applied for the estate EIN. If eligible to file Form 1023-EZ register for an account on Paygov. The person applying online must have a valid.

Complete Edit or Print Tax Forms Instantly. If you need additional assistance consult an accountant or. The estate consists of the real estate andor personal property of the deceased person.

You may apply for an EIN online if your principal business is located in the United States or US. File Your Taxes for Free. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ive tried the irsgov website and it always returns on the form. Locate an authorized e-file provider in your area who can electronically file your tax return. Access IRS Tax Forms.

Get or renew an individual taxpayer identification number ITIN for federal tax purposes if you are not eligible for a social security number. Number street and room or suite no. Prepare and file your federal income taxes online for free.

An estates tax ID number is called an employer identification number or EIN and comes in the. This is a secure application. Click Apply for New EIN.

Find Your Child Tax Credit Payment Information. Initial one-time action steps for Clubs. Special deadlines for taxpayers living.

Accessibility means ensuring access to information is available to the widest possible audience. Help - EIN Assistant. I know its late in the year but I just found out I needed it.

You can choose to have the EIN number given to you online in the form of a PDF document or you can. Complete the final steps and a PDF file will be created with your EIN. The easiest way to apply is online through the IRS website.

Note that each Account Transcript only covers a single tax year and may not show the most recent penalties interest changes or. Dont lose your refund by not filing even if you missed the deadline. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Enter 1023-EZ in the search box. An estate or decedent estate or succession is a legal entity created as a result of a persons death. Apply for an Employer ID Number.

Before filing Form 1041 you will need to obtain a tax ID number for the estate. You will need to log back in and start your submission again. Box number if mail is not delivered to street address City or town state and ZIP code if a foreign address see instructions.

Sign in to Your Account. An estates tax ID number is called an employer identification number or EIN and comes in the. You can also apply by mail or over the phone.

Filing past due returns. See more of IMSC - Independent Mystery Shoppers Coalition on Facebook.

Ein Comprehensive Guide Freshbooks

Irs Ein Application Reviews 43 Reviews Of Irs Ein Application Com Sitejabber

New Business Community Law Clinic At Berkeley Law Home Facebook

Ein Comprehensive Guide Freshbooks

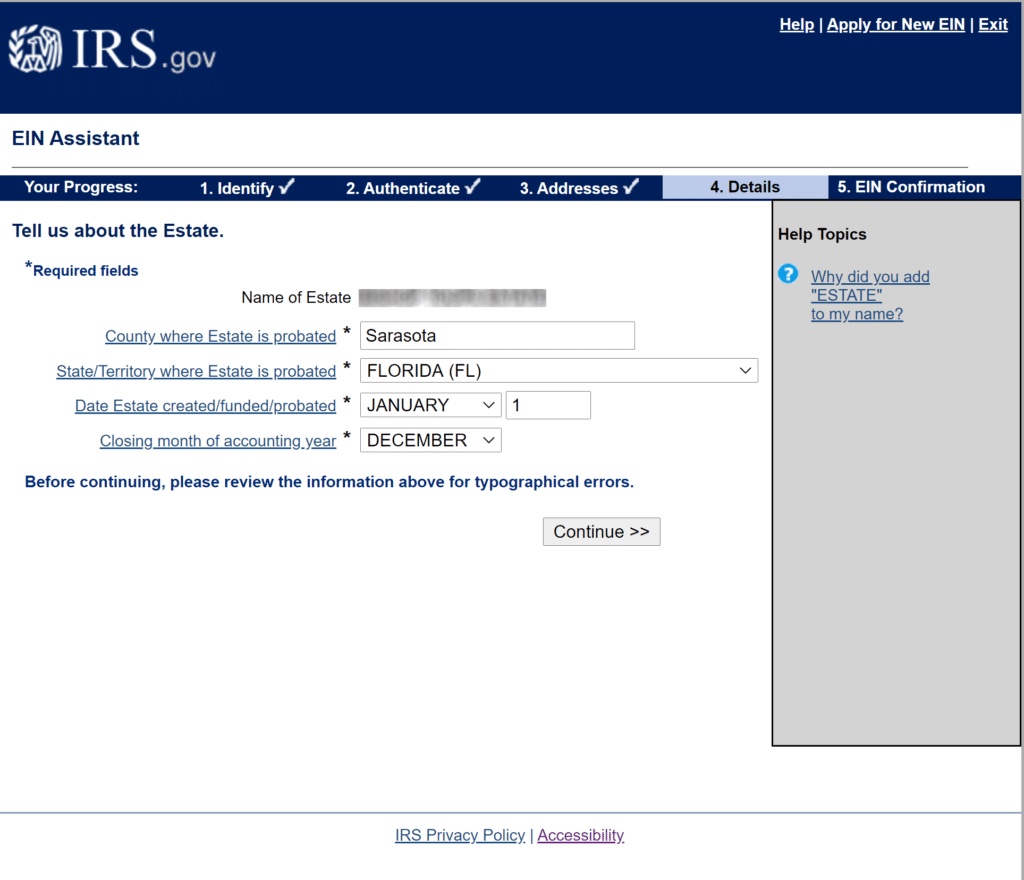

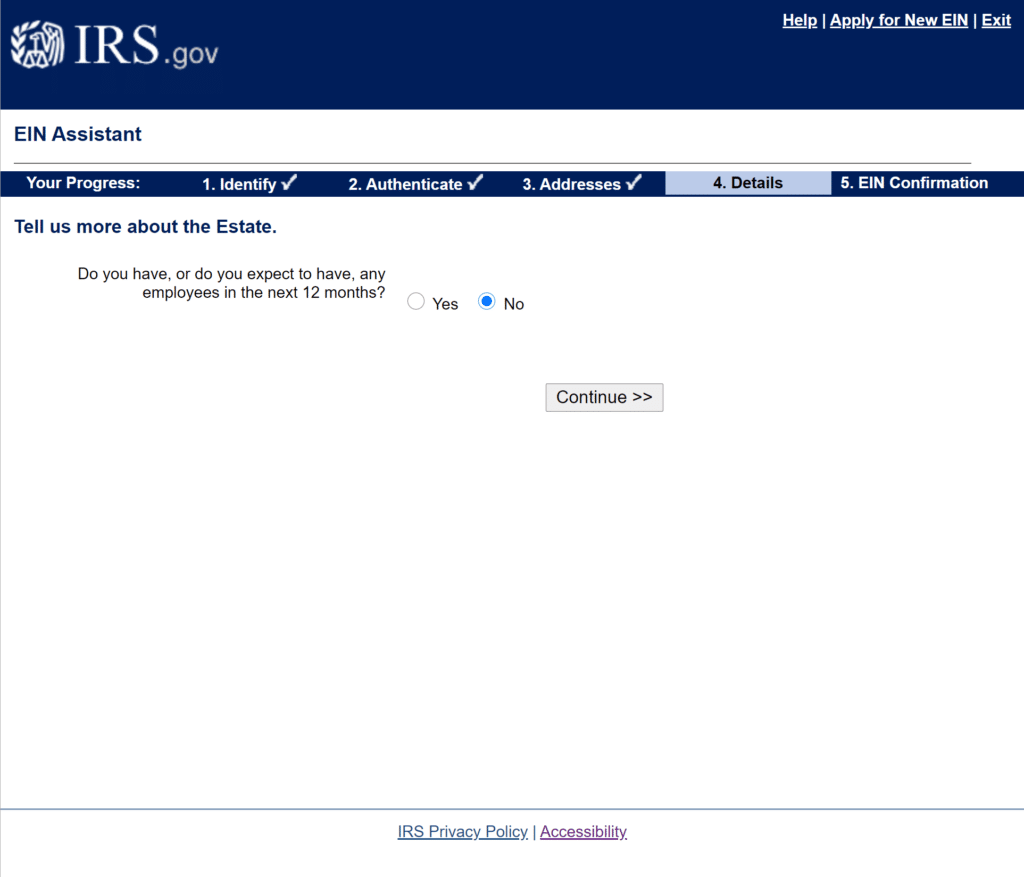

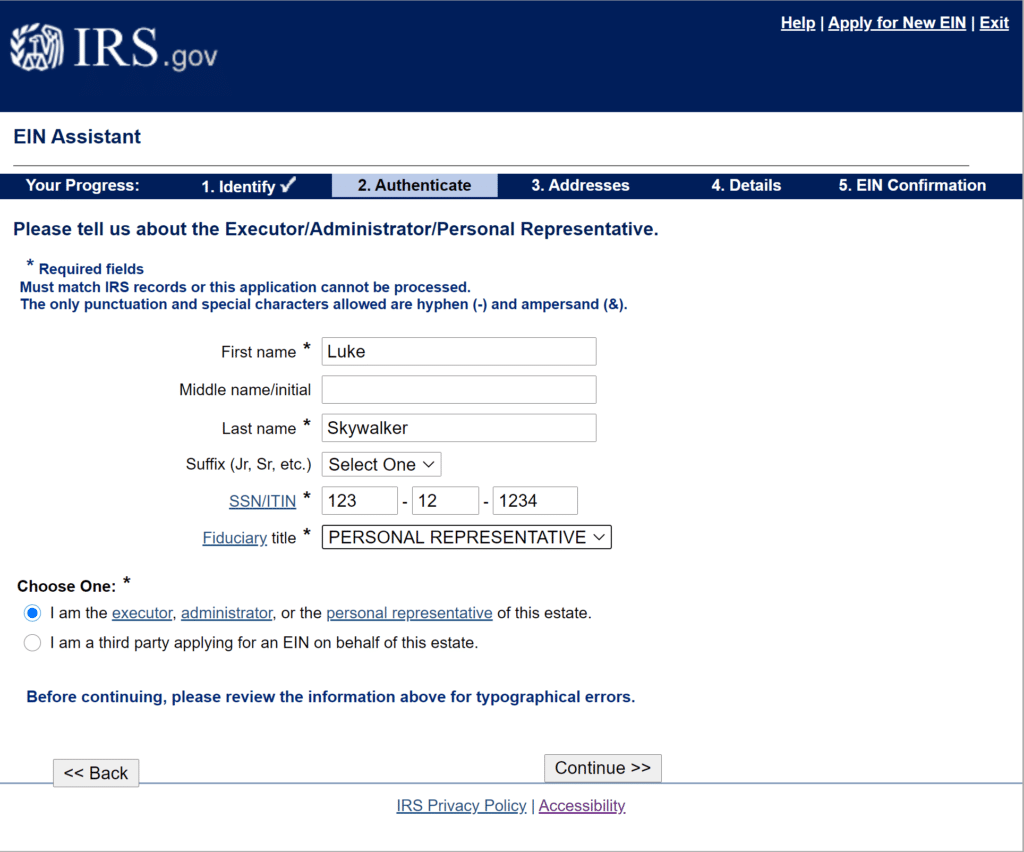

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

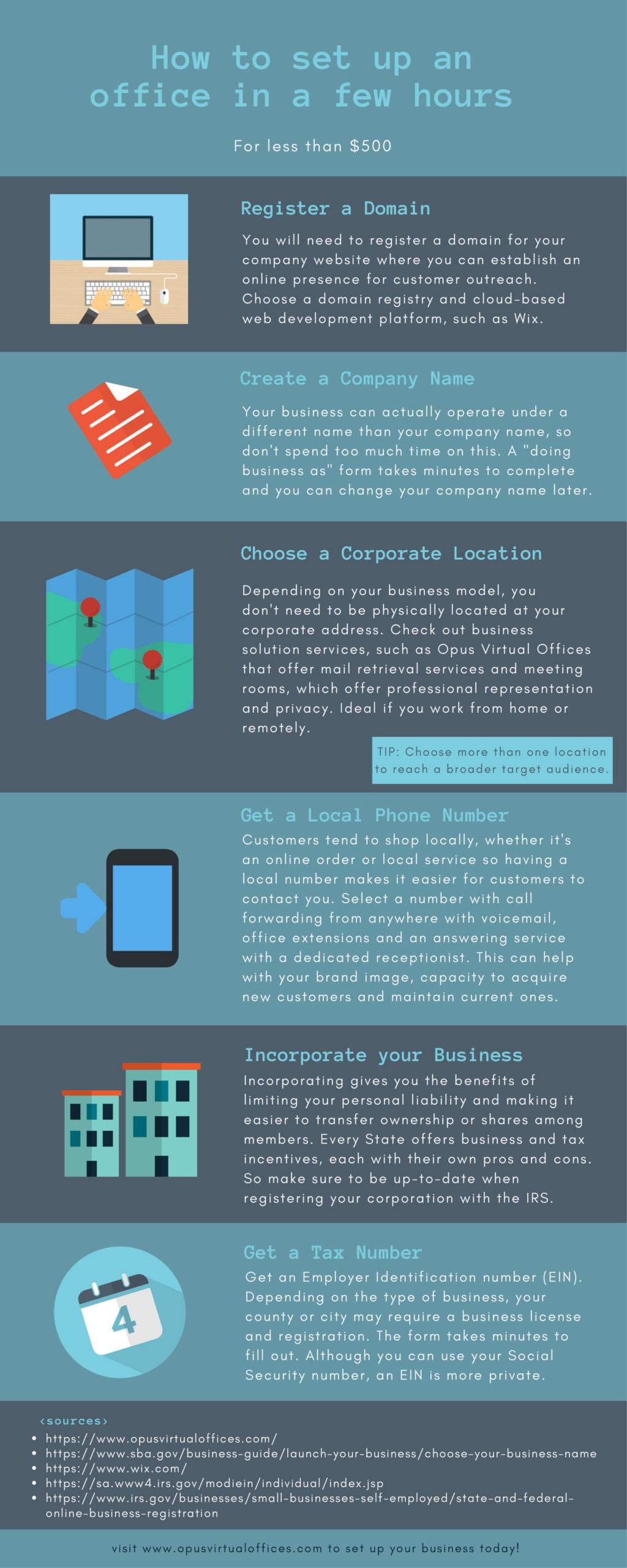

How To Setup A Home Office In A Few Hours

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Irs Ein Application Reviews 43 Reviews Of Irs Ein Application Com Sitejabber